In this guide I want to explain how much does it cost to sell on Amazon, an aspect that must be taken into account before starting such a business.

Did you take information on how sell on Amazon, you have looked at risks and opportunities and now you want to see if there is the right margin.

Although selling on Amazon is possible for everyone, it should also be made clear that there are some costs that can go to impact the margin, effectively zeroing out gains.

Amazon charges a 15% fee on each product sold, so if you have a lower margin it is not cost-effective to sell on Amazon's marketplace.

To start selling on Amazon you will face various costs that you need to take into account before starting the business. Let's see which ones.

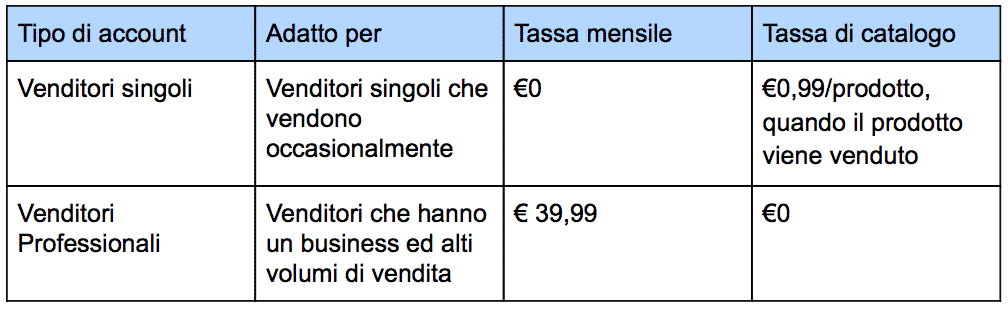

Seller account cost

The first cost is the cost of opening the account, which ranges from €0 for the basic account to that of €39 For the PRO account.

Basic account

- 0.00 Euro, of monthly fee.

- 0.99 Euro, fixed closing fee, when the product is sold.

- A referral fee for each product sold. This is a fee on transaction handling, varies by product category according to the Amazon Sales Commission Plan.

- A closing fee. This is a handling fee charged on Books, Music, Video, DV, Software and Video Games.

Professional account

- 39 Euro monthly, fixed cost.

- A referral fee for each product sold. This is a fee on transaction handling, varies by product category according to the Amazon Sales Commission Plan.

- A closing fee. This is a handling fee charged on Books, Music, Video, DV, Software and Video Games.

The major difference between the two accounts lies in the closing fee. For each order the basic account will be charged €0.99, while the pro account will not be charged at all.

So in the case of professional seller, you will not pay the fee on each product, which is convenient if you sell more than 40 products per month.

Commission costs

Reporting fee

For each product sold, Amazon retains a commission for reporting in varying percentages, which can range from as low as 7% up to 15% depending on the product category.

| Categories | Commission for reporting |

|---|---|

| Additive manufacturing | 12% |

| Amazon device accessories | 45% |

| Early childhood | 15% |

| Beer and wine | 10% |

| Spirits and spirits | 10% |

| Books, Music, Videos and DVDs | 15%* |

| Trade, Industry and Science | 15% |

| Cars and motorcycles | 15% |

| Informatics | 7% |

| Computer Accessories | 12% |

| Electronics | 7% |

| Large appliances | 7% |

| DIY | 12% |

| Teaching materials | 15% |

| Electronic Accessories | 12% |

| Flow control and filtration | 12% |

| Transfer of fluids | 12% |

| Food service equipment and supplies | 15% |

| Electrical installations | 12% |

| Industrial tools and equipment | 12% |

| Jewelry | 20% |

| Material transport products | 12% |

| Metalworking | 12% |

| Musical instruments and DJs | 12% |

| Energy transmission | 12% |

| Software | 15%* |

| Renewable energy supplies | 12% |

| Tires | 10% |

| Video Games - Games and Accessories | 15%* |

| Video game consoles | 8%* |

| Watches | 15% |

| Handmade | 12%** |

| Other products | 15% |

Closing fee

In the case of products in the Media category there is an additional closing fee of EUR 1.01 for Books, EUR 0.81 for Music, EUR 0.81 for Videos and DVDs, and EUR 0.81 for Video Games and Software.

Amazon FBA Costs

When selling on Amazon with the Fulfillment by Amazon program you must also take into account additional costs, the handling fee and the storage fee.

- Management fee. This is a fixed rate per unit sold and is set according to the type of product, its size and weight.

- Storage rate. It is applied per cubic meter occupied monthly by your item for sale and stored in Amazon warehouses.

The handling fee varies depending on the size and weight of the product. Below you can see an example of the cost for a small product on Amazon FBA.

Regarding the storage fee, a fee per cubic meter, this can be as follows:

- 26 Euro, is the rate Amazon charges from January to September.

- 36 Euro, is the rate charged from October to December.

In addition to these costs, it should be remembered that there are also the taxes to be paid on Amazon FBA earnings, which may affect the net profit according to the rate.

Please note that all this information is covered in full in the Amazon FBA course.

Additional costs

To all the costs we have listed, additional costs must be added. These relate to start-up costs, software or advertising campaign costs (pay per click).

Trademark registration

If you want to start selling on Amazon in private label, you obviously need to register your trademark, if you don't already have one registered.

Having your own brand allows you to establish yourself and differentiate yourself from the competition and also gives you the opportunity to join the Amazon brands register, with all the benefits that entails.

Software

To start an Amazon sales business, you obviously also need to know the market well and be able to understand the profit margins.

To analyze the sales of a particular product or compare the performance of a niche, you will need specialized software that allows you to do these analyses easily.

Currently the best software for Amazon FBA are Jungle Scout and Helium 10.

Initially you will need to purchase at least one of these two tools for Amazon FBA, you can then later decide to expand your arsenal by purchasing other software.

Advertisement

In the initial stage, it will be necessary to have some budget available to start sponsoring products and making initial sales.

Being featured on Amazon pages is not immediate and at least in the early days you will have to pay to be listed for searches for your product.

Website

This is an optional cost. You may decide to deal with it later. But it is something you will have to take into account.

I have produced an article in which I explain the advantages of having a website to sell on Amazon.